Executive Summery

This report presents a detailed overview of the Algorithmic Trading Market, highlighting key insights into its market size, share, and growth during the forecast period, i.e., 2023-28. It explores emerging trends, competitive dynamics, and the core drivers reshaping the industry. Backed by solid data and expert analysis, the study offers segment-wise insights and reliable forecasts to guide strategic decisions. With comprehensive market analysis and forward-looking perspectives, this report serves as a practical tool for stakeholders navigating change. Whether you're an investor, policymaker, or business leader, this research helps you stay ahead in the fast-evolving Algorithmic Trading industry landscape.

In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

Download your free sample PDF of the report– https://www.marknteladvisors.com/query/request-sample/algorithmic-trading-market.html

Algorithmic Trading Market Statistics and Key Highlights

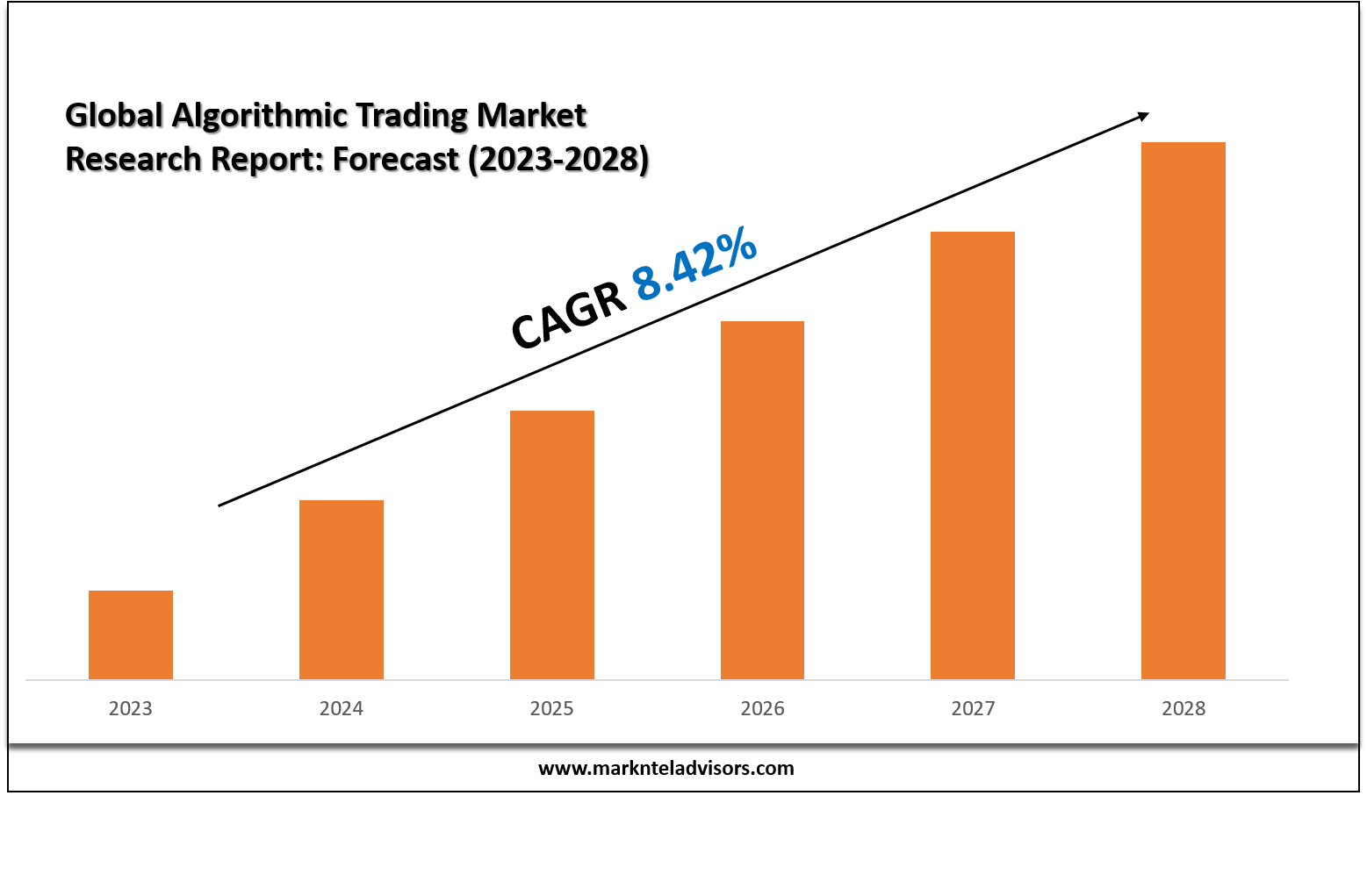

The Global Algorithmic Trading Market is anticipated to grow at a CAGR of around 8.42% during the forecast period, i.e., 2023-28.

- Algorithmic Trading market shows steady growth

- Market size expanding due to rising industry demand

- Competitive landscape driven by tech and innovation

- Detailed segment-wise and geography wise share analysis

- Forecast reveals strong trends shaping future outlook

Key Player- Emerging Algorithmic Trading Companies

- Tradetron (U.S.)

- Tickblaze LLC (U.S.)

- Wyden (U.S.)

- TradeStation (U.S.)

- InfoReach, Inc. (U.S.)

- Symphony (U.S.)

- ALGOTRADERS (U.S.)

- Argo Software Engineering (U.S.)

- FXCM Group (U.S.)

- Tata Consultancy Services Limited (U.S.)

- 63 Moons Technologies Limited

- Virtu Financial Inc.

- MetaQuotes Software Corp.

- IG Group

- Fernhill Corp.

- Finnova

- Multi Commodity Exchange of India Limited (MCX)

Access Full Market Insights & Key Statistics! https://www.marknteladvisors.com/research-library/algorithmic-trading-market.html

Use your official business email to connect with our team and enjoy full access with priority support.

Key Driver:

Rising Need for Efficiency & Profitability in Financial Markets: Market participants like institutional investors, hedge funds, and proprietary trading firms are driven by the desire for executing trades faster, more accurately, and at optimal prices. Algorithmic trading facilitates the automation of trade execution, the elimination of manual intervention, and the reduction of human error. Since algorithms can analyze substantial amounts of market data, identify patterns, and execute trades at ultra-high speeds, it enables market participants to react swiftly to market conditions.

Hence, the surging need for efficiency & speed to capture opportunities like price discrepancies, arbitrage, or momentum before they vanish and reduce transaction costs while enhancing overall trading performance is projected to drive the Global Algorithmic Trading Market during 2023-28.

Looking for Global, Regional or country-specific reports on this market?

Visit our website or simply fill out the inquiry form, and our team will reach out with customized insights and support - https://www.marknteladvisors.com/query/request-customization/algorithmic-trading-market.html

Algorithmic Trading Market Segmentation

By Type

- Stock Market- Market Size & Forecast 2018-2028F, Revenues (USD Million)

- Foreign Exchange- Market Size & Forecast 2018-2028F, Revenues (USD Million)

- Exchange-Traded Fund- Market Size & Forecast 2018-2028F, Revenues (USD Million)

- Bonds- Market Size & Forecast 2018-2028F, Revenues (USD Million)

- Cryptocurrencies- Market Size & Forecast 2018-2028F, Revenues (USD Million)

- Others (Commodities, Derivatives, etc.,) - Market Size & Forecast 2018-2028F, Revenues (USD Million)

Of them all, stock markets hold a notable share of the Global Algorithmic Trading Market as they are considered among the leading asset classes for trading various kinds of securities in a secured, managed, & controlled environment.

By Types of Traders

- Institutional Investors- Market Size & Forecast 2018-2028F, Revenues (USD Million)

- Retail Investors- Market Size & Forecast 2018-2028F, Revenues (USD Million)

- Long-term Traders- Market Size & Forecast 2018-2028F, Revenues (USD Million)

- Short-term Traders- Market Size & Forecast 2018-2028F, Revenues (USD Million)

By Components

- Solutions- Market Size & Forecast 2018-2028F, Revenues (USD Million)

- Platforms- Market Size & Forecast 2018-2028F, Revenues (USD Million)

- Software Tools - Market Size & Forecast 2018-2028F, Revenues (USD Million)

- Services- Market Size & Forecast 2018-2028F, Revenues (USD Million)

By Deployment

- On-cloud- Market Size & Forecast 2018-2028F, Revenues (USD Million)

- On-premises- Market Size & Forecast 2018-2028F, Revenues (USD Million)

By Region

- North America

- South America

- Europe

- Asia-Pacific

- Middle East and Africa

Of all regions globally, North America, particularly the US, holds a dominant position in the Algorithmic Trading Market, which owes to the region's advanced technological infrastructure, well-established financial markets, and a strong presence of market participants & technology providers.

Reasons to Buy This Report

- Gain comprehensive insights into current market trends and dynamics.

- Equip your business with data-driven strategies for informed decisions.

- Identify lucrative market opportunities and strategic growth areas.

- Analyze competitors to enhance your positioning in the market landscape.

- Understand geographical trends across diverse markets for better expansion strategies.

Other reports

- https://me-market-research-blog.blogspot.com/2025/06/adult-entertainment-market.html

- https://me-market-research-blog.blogspot.com/2025/06/uae-mammography-market.html

About US:

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

Contact Us:

MarkNtel Advisors LLP

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

For Sales Enquiries: sales@marknteladvisors.com