The Global Carbon Credit Trading Market research report provides a comprehensive overview of the current industry trends, key industry drivers, and competitive landscape within the sector. It delves into the impact of emerging technologies, business operations and consumer behavior. Additionally, the report analyzes the strategies of top companies in the Carbon Credit Trading industry and their positioning for future growth.

It also includes insights into recent market development, challenges faced by the industry, and potential opportunities for innovation and expansion. Overall, the report aims to offer valuable insights for industry stakeholders, investors, and decision-makers seeking to understand and navigate the rapidly evolving technology landscape.

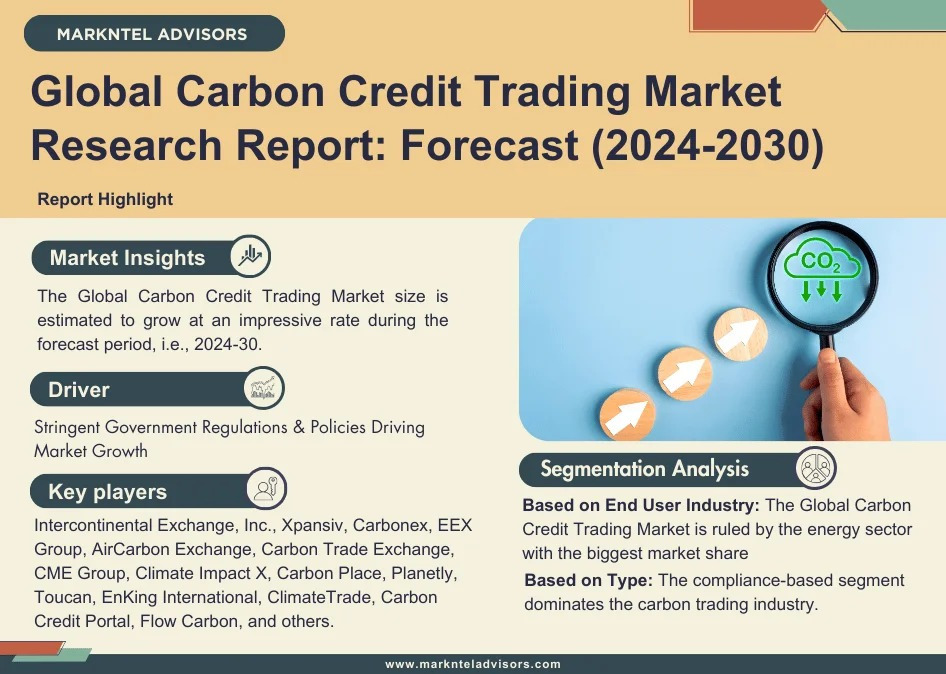

“According to research report, the Global Carbon Credit Trading Market size is estimated to grow at an impressive rate during the forecast period, i.e., 2024-30.”

Get Instant Access to the Report's Sample PDF - Click Here To Download: - https://www.marknteladvisors.com/query/request-sample/carbon-credit-trading-market.html

Carbon Credit Trading Market Trend

Integration of Blockchain & AI Gaining Traction – One of the emerging trends in the carbon credit trading industry is the integration of blockchain and AI, which is revolutionizing the monitoring, verification, and trading of carbon credits. Blockchain technology helps improve transparency, security, and traceability while preventing concerns like fraud and duplicate counting. This ensures that each carbon credit has a unique number. Market participants and regulators are more trusting of one another since this technology provides a permanent record of transactions.

On the other hand, AI improves data processing skills, making it possible to measure, report, and verify (MRV) emissions reductions with greater precision. Large datasets may be processed by AI algorithms to forecast market trends, optimize trading techniques, and track impacts on the environment in real-time. When used in tandem, blockchain and AI improve the efficiency, dependability, and transparency of the carbon credit trading system, drawing more players and augmenting the revenue growth of the market.

Carbon Credit Trading Market Segmentation Analysis:

By Type

- Voluntary – Market Size & Analysis By Revenues- USD Million

- Compliance Based – Market Size & Analysis By Revenues- USD Million

By End User Industry

- Energy – Market Size & Analysis By Revenues- USD Million

- Power generation

- Oil and gas

- Renewable Projects

- Manufacturing and Heavy Industry– Market Size & Analysis By Revenues- USD Million

- Cement

- Steel

- Chemicals

- Others

- Transportation– Market Size & Analysis By Revenues- USD Million

- Aviation

- Marine

- Automobile OEMs

- Forestry and Agriculture – Market Size & Analysis By Revenues- USD Million

- Others– Market Size & Analysis By Revenues- USD Million

The Carbon Credit Trading Market is ruled by the energy sector with the biggest market share. It is likewise expected that this sector will maintain its dominant position during the forecast forecast period. The foremost issue in the back of this domination is the large quantities of greenhouse fuel emissions generated by power plants, the extraction of oil & gas, and other electricity-associated activities. The energy segment is a key participant in carbon buying and selling because it comes below strict regulatory frameworks. Companies working inside the energy industry can buy and sell carbon credits to offset their emissions and fund the development of greener technology via collaborating in carbon buying and selling.

By Type of Enterprises

- Large Enterprises– Market Size & Analysis By Revenues- USD Million

- Medium & Small Enterprises – Market Size & Analysis By Revenues- USD Million

By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Unlock the Detailed Analysis - Click to View Full Report. - https://www.marknteladvisors.com/research-library/carbon-credit-trading-market.html

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Carbon Credit Trading Market Competitive Landscape:

Some of the top notch Carbon Credit Trading companies operating in the market include Intercontinental Exchange, Inc., Xpansiv, Carbonex, EEX Group, AirCarbon Exchange, Carbon Trade Exchange, CME Group, Climate Impact X, Carbon Place, Planetly, Toucan, EnKing International, ClimateTrade, Carbon Credit Portal, Flow Carbon, and others..

Key Questions Answered in the Research Report

- What are the Carbon Credit Trading industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the market?

- What key factors would propel and impede the market growth?

- How has the industry been evolving in terms of geography & product adoption?

- How has the competition been shaping up across various regions?

- How have buying behavior, customer inclination, and expectations from product manufacturers been evolving during 2024-30?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

About us:

We are a prominent consulting, data analytics, and market research firm that offers a broad spectrum of strategic reports across diverse industry verticals. As a dedicated qualitative & quantitative research company, we aim to provide comprehensive data services to a diverse client base, which includes multinational corporations, financial institutions, governments, and individuals, among others.

Having established our presence in the market for many years, we have conducted multi-industry research across 80+ countries, ensuring a global reach across regions such as America, Asia-Pacific, Europe, the Middle East & Africa. Notably, we have also successfully operated in countries including the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and various others, catering to diverse regional requirements.

More Trending Reports:

- https://dutchmanresearch.blogspot.com/2024/09/spinal-muscular-atrophy-sma-treatment.html

- http://prsync.com/markntel-advisors/video-on-demand-market-growth-key-players-strategic-trends-and-opportunities-4296732/

- https://uberant.com/article/2050411-aerogel-market-latest-innovations-drivers-dynamics-and-strategic-analysis-2030/

For Media Inquiries, Please Contact:

Phone: +1 628 895 8081 | +91 120 4278433

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India