Malaysia Online Insurance Market Overview: Latest Trends, Industry Size, Share and Growth Projection

“Markntel Advisors – Leading Market Research Company” has recently conducted a comprehensive examination of the Malaysia Online Insurance Market, encompassing the forecast period from 2024-30. Utilizing data from the historical period of 2019-22, with 2023 serving as the base year, our proficient team of analysts has devoted considerable time to gather and scrutinize the latest market information. The result is a thorough and current report that proves valuable for individuals making data-driven decisions, including business owners and analysts. Whether your objective is to explore new markets, introduce a new product, or maintain a competitive edge, our research report on the Malaysia Online Insurance Market offers well-researched facts and figures relevant to the industry.

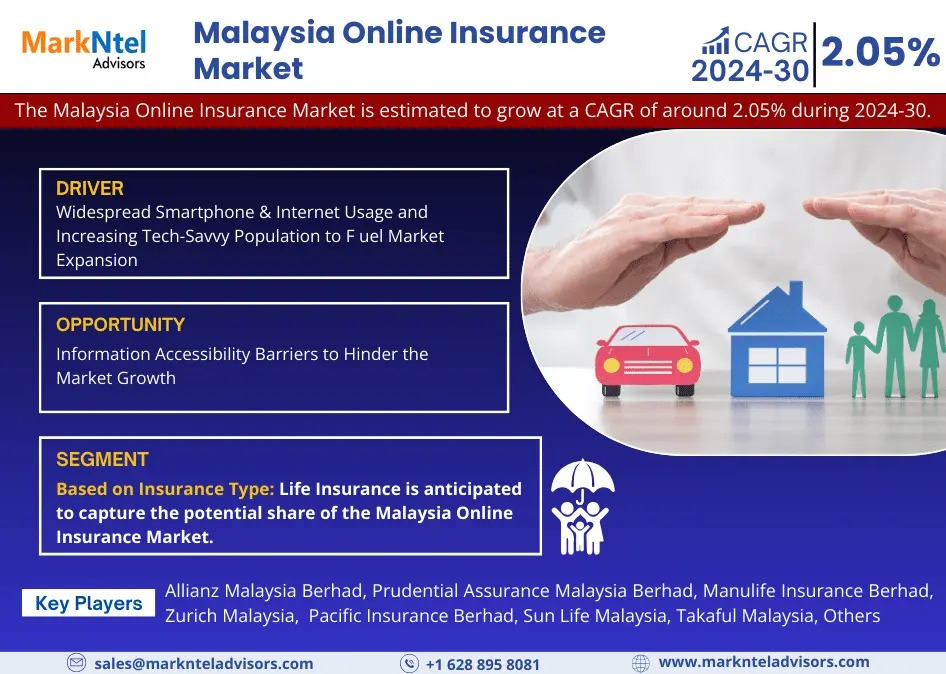

Malaysia Online Insurance Market Driver

Widespread Smartphone & Internet Usage and Increasing Tech-Savvy Population to Fuel Market Expansion – The widespread adoption of smartphones and easy access to the internet has been instrumental in shaping the Malaysia Online Insurance Market. The younger demographic, particularly Malaysians, is becoming more connected, turning online platforms into a convenient channel for insurance transactions and driving market growth. Additionally, the country's tech-savvy population, comfortable with digital tools and online transactions, has played a crucial role in the success of online insurance platforms. This inclination towards embracing technology has further heightened the demand for online insurance, contributing to the market's upward trajectory.

For Report Free Sample PDF, Sent Your Inquiry Here – https://www.marknteladvisors.com/query/request-sample/malaysia-online-insurance-market.html

Malaysia Online Insurance Market Segmentation Analysis:

The Malaysia Online Insurance Market displays a notable combination of robustness and fragmentation, featuring various segments each further subdivided into various sub-segments. Recognizing the significance of market segmentation is crucial for businesses aiming to tailor their strategies, products, and services to align with the specific needs and demands of their target customers. A thorough analysis of market segments and their associated sub-segments empowers businesses to pinpoint new growth opportunities, predict market trends, and devise impactful marketing and sales strategies.

The Malaysia Online Insurance Market is segmented as follows:

By Insurance Type

- Life Insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Health insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Motor Insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Home Insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Others (Vehicle Insurance, Property Insurance, etc.)- (Market Size & Forecast 2019-2030, (USD Million)

By End User

- Individual Consumers- (Market Size & Forecast 2019-2030, (USD Million)

- Business Entities- (Market Size & Forecast 2019-2030, (USD Million)

- Transport & Logistics Companies - (Market Size & Forecast 2019-2030, (USD Million)

- Financial Institutions- (Market Size & Forecast 2019-2030, (USD Million)

- Others (Healthcare Providers, Government Entities, etc.)- (Market Size & Forecast 2019-2030, (USD Million)

By Enterprise Size

- Large Enterprises- (Market Size & Forecast 2019-2030, (USD Million)

- SMEs- (Market Size & Forecast 2019-2030, (USD Million)

By Region

- North

- South

- East

- Central

- Sarawak

- Sabah.

Access Full Insight of Study [Include Description + TOC], - https://www.marknteladvisors.com/research-library/malaysia-online-insurance-market.html

Leading Malaysia Online Insurance Market Player

The report delves into key market players and thoroughly examines their strategic approaches, trends, innovations, and manufacturing infrastructure to project their anticipated market presence over the next five years. The researched data has the capability to differentiate even novice entrants in the long term. Armed with pertinent data and actionable insights, our research report presents a comprehensive landscape of the market, empowering investors and stakeholders to establish a robust position in the Malaysia Online Insurance market. Highlighted in the research report are major players, including:

- Allianz Malaysia Berhad

- Prudential Assurance Malaysia Berhad

- AIA Bhd.

- Manulife Insurance Berhad

- Zurich Malaysia

- Hong Leong Assurance Berhad

- Pacific Insurance Berhad

- Sun Life Malaysia

- Takaful Malaysia

- Generali Insurance Malaysia Berhad

- Great Eastern Life Insurance (Malaysia) Berhad

- Others (Etiqua Insurance Berhad, AM Assurance, etc.).

accompanied by their respective net worth and valuation in USD.

Note - If there are any particular details you need that are not currently included in the report, we will be happy to provide them as part of our customization services.

Key Questions Answered in this Malaysia Online Insurance Market Analysis Report

- What is the current size of the Malaysia Online Insurance Market, and what factors contribute to its growth or contraction?

- How does the Malaysia Online Insurance Market share compare among key players, and what strategies are they employing to gain a competitive advantage?

- What latest trends are emerging in the Malaysia Online Insurance Market, and how are these trends expected to evolve in the foreseeable future?

- What is the demand outlook for the Malaysia Online Insurance Market, and how is it influenced by industry-specific factors and broader economic trends?

- What opportunities exist in the Malaysia Online Insurance Market for investors, and what are the latest investment trends and preferences in this sector?

Who We Are –

We are a leading market research company, consulting, & data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, & individuals, among others.

Our specialization in niche industries & emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, & trend analysis, among others, for 15 diverse industrial verticals.

Contact Us –

Call +1 628 895 8081 +91 120 4278433

Email: sales@marknteladvisors.com